Top 10 challenges holding CAS practices back (and how Ignition helps solve them)

Client accounting and advisory services (CAS) is becoming one of the most strategic growth areas for modern accounting firms. As more clients expect operational support, proactive insights, and ongoing financial guidance, CAS practices are positioned to deepen relationships and create predictable recurring revenue.

But moving from compliance work to a scalable CAS model is not simple. Firms often struggle with capacity, manual processes, inconsistent pricing, limited client understanding, and fragmented tech stacks. These challenges limit profitability and slow down growth.

The good news is that every CAS engagement begins in the same place. It starts with how you sell and how clearly you define what you will deliver and how you will get paid. This is where Ignition becomes the foundation for scalable CAS growth. Ignition helps firms sell, bill, and get paid in one platform so they can operate more efficiently, protect cash flow, and unlock advisory capacity.

“It all starts with Ignition. Every client agreement sets the tone for revenue, efficiency, and advisory success.”

Justin Kurn, Chief Revenue Officer, Dark Horse CPA

Here are some of the biggest challenges facing CAS practices today and how Ignition helps firms solve them from proposal to payment.

1. Talent constraints slow down CAS growth

Finding, developing, and retaining advisory talent is one of the top barriers firms face in CAS expansion. Upskilling people for advisory services (data, finance ops, industry fluency) remains one of the top constraints, and talent ranks as a leading priority alongside automation. Firms need team members with financial analysis expertise, industry fluency, and the ability to guide clients, despite the industry-wide talent shortage. But many CAS professionals spend hours on admin tasks like issuing invoices, managing signatures, chasing payments, and reconciling billings.

How Ignition helps CAS teams reclaim time

Ignition reduces manual work by automating the entire client agreement and revenue process. Firms use Ignition to:

- Automate proposals, agreements, invoicing, and payment collection

- Standardize CAS templates to reduce repetitive tasks

- Trigger downstream workflows through integrations with Karbon, Financial Cents, Thomson Reuters’ Onvio Firm Management and Practice CS, Wolters Kluwer’s CCH Axcess, and more

Customers save up to 18 hours per week, which frees advisory talent to focus on analysis and client relationships instead of admin tasks.

“There was no reason now not to use Ignition. Across the board, it created a seamless experience for everybody involved, and it has now become the standalone tool that we use for those three areas, proposals, engagement letters, and payment processing.”

— Justin Kurn, Chief Revenue Officer, Dark Horse CPA

2. Clients don’t understand the value of CAS

Clients often understand tax and bookkeeping services but struggle to see the value of budgeting, forecasting, financial planning, and year-round advisory support. This can lead to longer sales cycles and hesitancy to invest in advisory services.

How Ignition helps firms communicate CAS value clearly

Ignition proposals make your advisory value tangible by:

- Packaging CAS offerings into clear service options

- Including tiered pricing options so clients can compare outcomes and value

- Adding optional add-ons that make upselling straightforward

- Presenting scope, pricing, and contract terms in one easy-to-review online proposal

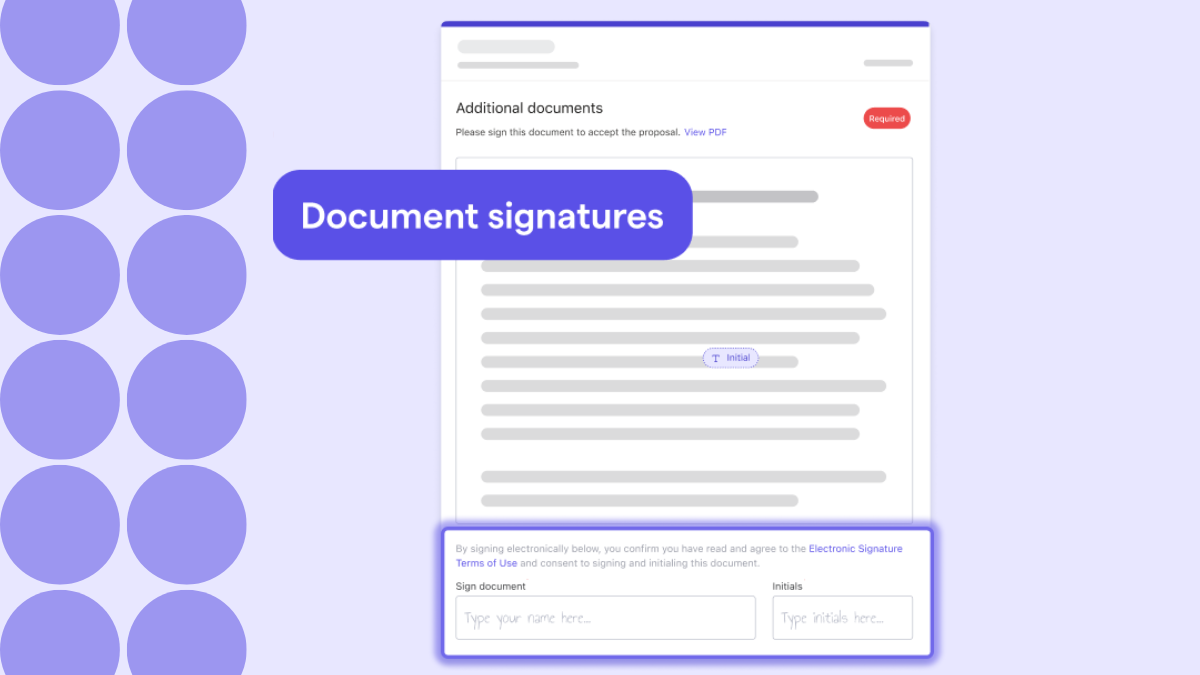

Integrated e-signature and automated reminders keep deals moving and help clients understand your services from the start.

3. Pricing, packaging, and scope control limit profitability

The shift from hourly work to advisory subscriptions is important, but many firms still underprice CAS packages or allow scope creep to erode margins. Industry guidance encourages firms to implement change orders, revisit pricing annually, and prevent unbilled work, but many firms aren’t following suit.

How Ignition strengthens CAS pricing and revenue discipline

Ignition helps CAS practices:

- Build standardized CAS service packages

- Present multiple options and upsells in one proposal

- Use change orders to adjust active services without confusion

- Bill immediately for extra work using Instant Bill (without a new proposal)

- Raise prices automatically during renewals

This gives firms confidence to price strategically and ensures they get paid for all of the work they deliver.

4. Tech fragmentation creates inefficiency and inconsistent client experiences

CAS teams rely on multiple systems to manage agreements, invoicing, payments, onboarding, and workflow management. Switching between tools creates extra work and makes it harder to deliver a consistent experience. Many firms also struggle to stay up to date with evolving automation and AI capabilities.

How Ignition simplifies the CAS tech stack

Ignition connects proposals, billing, and payments in one platform. It integrates with:

- QuickBooks Online and Xero

- Wolters Kluwer’s CCH Axcess

- Thomson Reuters’ Onvio Firm Management, Practice CS, and UltraTax

- Karbon, Financial Cents, Gusto, and Intuit ProConnect

- Zapier for custom app connections

Client acceptance can automatically trigger downstream tasks, which reduces manual work and eliminates disconnected processes.

See how Ignition streamlines proposals, billing, and payments from end to end.

5. CAS practices need internal alignment to scale

Scaling CAS requires clear roles, consistent pricing, standardized packages, and predictability across partners and teams. Many firms struggle to maintain alignment, which leads to inconsistent client experiences and inefficiencies.

How Ignition brings alignment across the firm

Ignition provides standardized templates for:

- Proposals

- CAS service packages

- Contract terms and client communications

With a single source of truth for what you sell and how you bill, firms achieve greater consistency and build a scalable CAS operating model.

“We were spending so much time on proposals and billing that it slowed down our ability to scale. The client experience wasn’t where we wanted it to be, and we needed a solution that would modernize the process.”

— Justin Kurn, Chief Revenue Officer, Dark Horse CPA

6. Firms need a repeatable CAS sales and onboarding motion

CAS is not sold the same way as compliance work. It requires clarity, education, and a smooth onboarding process. Many firms struggle to explain CAS to prospects and do not have a consistent workflow from proposal to kickoff.

How Ignition helps firms establish a predictable CAS sales process

Ignition enables a clear front door to your CAS practice with:

- Professional proposals that make value obvious

- Online acceptance that reduces friction

- Collection of payment details upfront to prevent late payments

- Automatic invoicing and payment collection once the proposal is accepted

This shortens sales cycles and ensures every new CAS client starts with clarity.

7. Delivering insights at scale is difficult for CAS teams

CAS 2.0 encourages firms to move beyond reporting and provide proactive insights using KPIs and planning. Many firms struggle to maintain consistency in this insight layer because they lack visibility into revenue, client commitments, and billing patterns.

How Ignition supports insight-driven advisory work

While Ignition is not a BI platform, it gives CAS leaders the operational visibility they need to support meaningful advisory conversations. Billing Automation and Business Insights provide clarity into:

- Projected revenue with Business Insights

- Payment status

- Upcoming renewals

- Client billing rhythms

This helps CAS leaders plan resourcing and deepen client advisory relationships.

8. Regulatory and independence requirements add complexity

As CAS grows relative to audit, firms face increasing independence considerations and need stronger documentation for quality and compliance. Clear agreements help firms avoid misunderstandings and support risk management processes.

How Ignition improves documentation and compliance

Ignition helps firms create standardized, professional service agreements that clearly define:

- Scope of work

- Fees and pricing

- Roles and responsibilities

This level of clarity supports independence requirements and enhances overall compliance readiness.

9. Cash flow instability limits CAS potential

Even firms that price CAS effectively struggle with inconsistent invoicing and delayed payments. Without upfront payment details or automated billing, firms deal with late payments, manual follow-ups, and unpredictable cash flow.

How Ignition helps firms eliminate late payments

Ignition helps CAS practices build predictable revenue by enabling firms to:

- Collect payment details upfront

- Automate recurring billing

- Reduce unpaid invoices and manual follow-ups

- Accept credit card and ACH payments

With 91% of payments collected automatically in Ignition, firms gain confidence in their cash flow.

10. Manual processes slow down CAS transformation

As firms expand CAS offerings, manual processes cause delays, errors, and inconsistent client experiences. This hinders growth and creates operational bottlenecks.

How Ignition accelerates CAS transformation

Ignition centralizes proposals, billing, payments, change orders, and renewals in one place. This helps firms:

- Launch CAS services faster

- Standardize processes and agreements

- Automate manual tasks

- Scale without adding complexity

- Build a seamless client experience

Ready to scale your CAS practice?

See how Ignition helps CAS firms sell, bill, and get paid with complete clarity.

Explore how Ignition can help you scale advisory services without adding chaos.