Use automation to reduce accounts receivable and improve cash flow

Key takeaways

- Managing accounts receivable (AR) effectively is crucial to maintaining a healthy cash flow and financial stability.

- Late payments and delinquent accounts can cause significant cash flow problems and hinder business growth.

- Accounting and tax professionals can use several strategies to optimize AR.

- Software can automate the entire invoicing process, enabling you to achieve a zero accounts receivable practice, saving you time and money.

Cash flow is the lifeblood of any business, and managing it effectively is crucial for success. It determines a company's ability to meet its financial obligations, invest in growth opportunities, and maintain its day-to-day operations. As an accounting and tax professional, you understand this better than anyone.

One of the biggest obstacles to sustaining healthy cash flow is managing AR. Late payments and delinquent accounts can cause significant cash flow problems, leading to missed opportunities, increased debt, and even business failure. Ignition’s 2022 State of client engagement in the US reports that more than nine out of 10 accountants and bookkeepers (94%) need to chase clients for late payments. On average, 31% of invoices are paid late.

Fortunately, there’s a solution: software that ends late payments, eliminates AR, and improves your cash flow. Read on to explore how implementing accounts receivable automation software can help reduce your outstanding receivables and improve your cash flow.

What are accounts receivable?

Accounts receivable refers to the money owed to a business for goods or services it has provided to its clients on credit. In other words, it comprises the outstanding invoices for which a business has yet to receive payment. AR is an essential part of the cash flow cycle because it represents the money that a business is due and expects to receive in the near future. So, managing AR effectively and efficiently is vital to maintaining a healthy cash flow and financial stability.

Why are accounts receivable a problem?

When a business doesn’t collect AR in a timely manner or when clients don’t pay on time, this can create serious cash flow problems and hinder business growth. It ties up the business's resources, and can even impact its ability to pay its own bills and expenses.

What’s more, tracking and collecting AR can be time-consuming, costly, and frustrating. Delayed or unpaid AR can harm business relationships, tarnish the firm’s reputation, and impact overall financial security.

Strategies to optimize accounts receivable

There are a number of tactics accounting and tax professionals can use to reduce their AR and improve their financial health. These include:

Establishing clear payment terms and promptly following up on late payments.

Offering early payment incentives and considering alternative financing options such as factoring.

Implementing credit checks and monitoring customer payment history, which can help identify potential risks before extending credit.

Use software to automate accounts receivable

These are all good options for dealing with existing AR, but there’s one more important strategy to throw into the mix that’s a must-have for any firm: leveraging software to help prevent and eliminate AR altogether.

Related article: Download your Step-by-step guide: How to achieve a zero accounts receivable practice

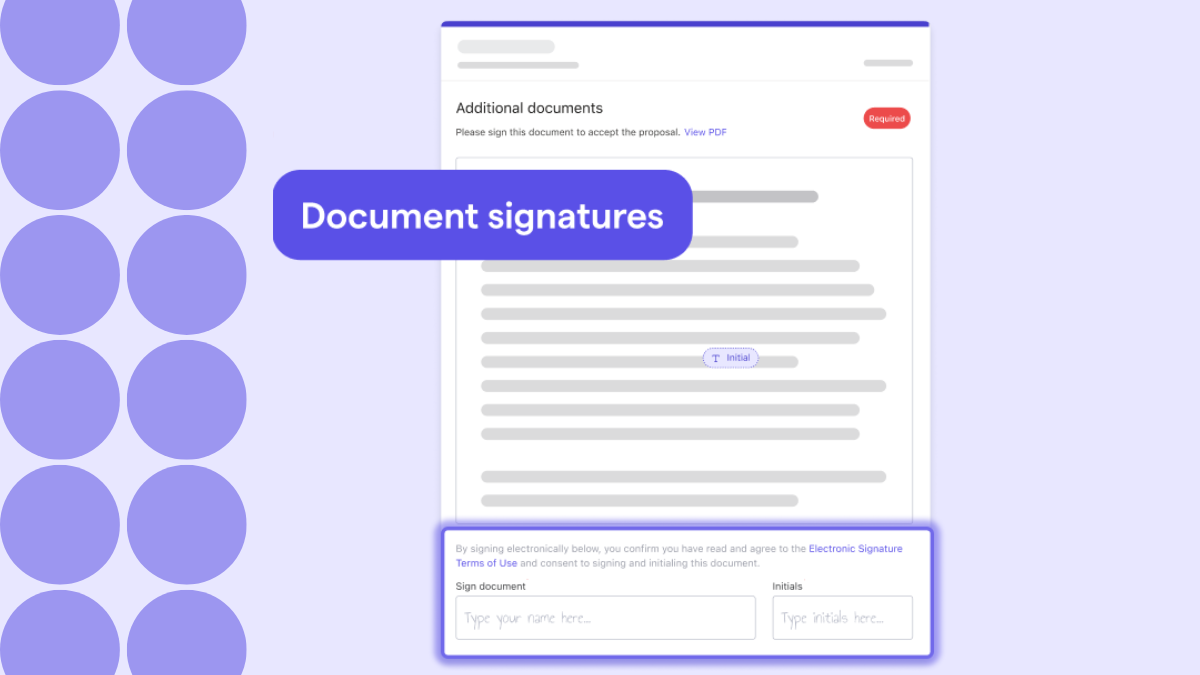

With accounts receivable software such as Ignition, you can take your AR to zero and say goodbye to late payments. Rather than billing and getting paid (fingers crossed!) for work after completion, you can collect client payment details upfront, as well as deposits right from when a client signs your proposal. This reduces the risk of late or non-payments.

The sooner you invoice your clients, the sooner you get paid! In Ignition, you can also invoice your clients automatically by connecting Ignition to QuickBooks Online or Xero. You can even send automated reminders when a bill approaches its due date.

Your clients can pay automatically using a credit card, Automated Clearing House (ACH) or pre-authorized debit (PAD). By setting up the system to automatically withdraw funds by a specific date, everything happens behind the scenes. It’s a better experience for your clients and you can eliminate the need to chase payments.

Because Ignition integrates with your accounting systems to pull invoice data, this also reduces manual data entry errors. It provides real-time visibility into AR, allowing you to better forecast and manage cash flow. It’s the ultimate system for accounting and tax firms to streamline their AR process.

Establishing clear payment terms

Top tip: Engagement letters are the best way to safeguard your position and cash flow without damaging client relationships, especially when combined with regular invoicing and taking control of payments.

Charging for out-of-scope requests

Accounts receivable automation software that makes it easy for you to make changes to agreed services can also help to improve your cash flow. With Ignition’s Service Edits feature, you can adjust the price, quantity or billing details of your services – even after these have been accepted by your client. When you make any of these changes, the platform notifies your client of adjustments to the agreement without the hassle of signing a whole new proposal.

Save hours on mundane admin

There are a growing number of success stories of firms that are saving time and money with accounts receivable software like Ignition, that eliminates AR. The time-savings comes from automating repetitive manual tasks and streamlining the collections process. It improves efficiency, reduces human error, and eliminates the costs associated with time-consuming manual processes and delayed payments.

For example, Ignition customers save on average 18 hours per week engaging clients, managing scope changes, and billing, collecting and reconciling payments.

Over to you

You know the tools you need to build a zero AR practice, so you can focus on what’s important: providing exceptional service to your clients. If you’re ready to get started, Ignition can be a big help. Watch the online demo and find out how you can get paid faster, improve your cash flow, and ultimately increase your profitability.