Navigating key IRS updates for 2024 with Eric Green

Subscribe to Eric Green’s weekly blog: Get Eric’s exclusive tips and insights about how to tackle the biggest challenges facing CPAs delivered straight to your inbox. Subscribe now.

I’d like to bring you up to speed with some major announcements from the IRS that are set to make a significant impact in 2024.

These updates are crucial for tax professionals and their clients alike as we navigate the evolving landscape of IRS policies and procedures. Below, I dive into these pivotal changes and how they could affect your practice and clientele in the upcoming year.

1. Resumption of automated IRS enforcement

For those deeply involved in IRS representation, this first announcement won't come as a surprise. Amidst the pandemic, the IRS had halted all automated enforcement activities to ease the burden on taxpayers.

This pause was partly due to logistical challenges, as evidenced by the backlog of 12 million unopened mail pieces. But now, the IRS is back on track and is ready to restart its automated enforcement processes, including liens, substitutes for returns, and levies, started January 2024.

For professionals waiting for this wave of work, the time has come.

For those of you who don’t do IRS Tax Representation in your firm, it’s a great way to expand your services as many folks will need additional support.

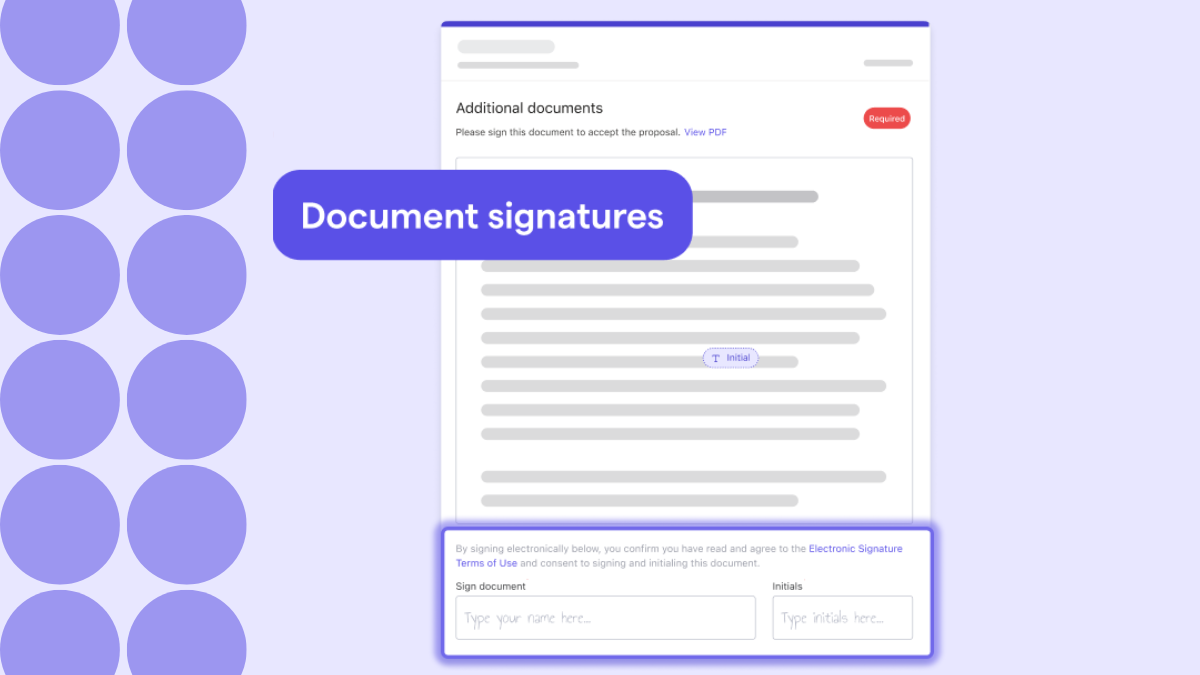

For those of you using Ignition, you have the advantage to leverage engagement letters and checklists for dealing with liens, notices of deficiency, and collection cases. These resources, including those for installment agreements, are now readily available in Ignition, streamlining your workflow and ensuring you don't have to start from scratch. If you aren’t currently using Ignition, make sure you start a trial today.

Related content: Top 10 ways accountants can profit with the IRS strategic plan

2. IRS's penalty abatement for 2021 tax returns

In a significant move, the IRS has decided to voluntarily abate penalties on the 2021 tax returns. This decision will aid about 4.7 million taxpayers, waiving over a billion dollars in tax penalties.

It's a gesture of goodwill from the IRS, intended to support taxpayers who faced hardships during COVID-19. This move will also help to reduce the IRS's backlog of requests for abatement.

3. The ERC program update

The final announcement revolves around the Employee Retention Credit (ERC) program. In response to rampant fraud, the IRS had previously paused processing ERC claims. Now, they've introduced a voluntary disclosure program, allowing businesses to come forward and settle their claims at 80 cents on the dollar.

This initiative offers a substantial incentive, as the IRS aims to resolve these issues without resorting to stringent enforcement measures. This program ends March 22, 2024, so taxpayers who need to apply must do so quickly.

Navigating new IRS changes with confidence and ease

These announcements from the IRS signal a significant shift in how we'll approach tax representation and client assistance in 2024. But with Ignition, you’ll be well-equipped to handle these updates with confidence.

The platform features my own Tax Rep Network proposal templates, with more templates coming this year. And you can collect payment upfront in your proposal, before you start working with clients, so you’re not left chasing late payments after you’ve filed those returns.

The benefits don’t end there. When you connect Ignition with Intuit ProConnect, you can make engaging clients and getting paid this tax season a breeze. Import your ProConnect clients into Ignition, filter clients by return type, and send tax proposals to multiple clients in bulk using templates. Once clients sign, Ignition automatically creates invoices, collects payments, and marks invoices as paid in QuickBooks Online.

As we continue to explore the shifting sands of tax law, IRS procedures, and client relationships, don’t forget to subscribe to my monthly blog below and listen to my podcast. You’ll get my exclusive tips and insights delivered straight to your inbox, each and every month.

See you next time.