Hacking the tax code: How AI and cloud tech are rewriting accounting rules

Time is money, whether you're steering an accounting and tax firm or mastering the ins and outs as a professional.

But what if your tech stack is so outdated it makes fax machines look cutting-edge?

According to The Wall Street Journal, the Internal Revenue Service (IRS) is still grappling with tech “so old it makes the typical member of Congress look young".

Enter the 21st century.

Tech is infiltrating even the most change-resistant corners of the professional world. This includes the US tax systems.

The IRS is in the middle of a multiyear modernization plan to resuscitate its aging infrastructure.

At the same time, today’s accounting and tax professionals are evolving into invaluable strategic advisors.

Artificial intelligence (AI) and other technologies are equipping them to navigate far beyond the conventional territory of numbers and forms.

This evolution frees them from inefficient, old school practices that eat into profits and make them work longer hours. Instead, they’re embracing change and choosing to run more profitable firms.

If you're not evolving like this, it’s time you caught up.

In a rapidly evolving tax landscape, using cutting-edge technology is no longer optional. It’s a prerequisite for running a high performing, sale-ready firm.

As we delve into the specifics below, you'll discover how these innovations can transform your practice – ensuring you won’t get left behind.

The new disruptors that are shaking up the status quo

AI and ML aren't just buzzwords from the tech industry.

They're rapidly taking on a significant role in the field of taxation, too.

By automating routine tasks, these powerful tools streamline your often complex and time-consuming processes (such as data entry and retrieval), and can dramatically increase accuracy.

These technologies can also help prevent fraud by analyzing data and highlighting patterns or anomalies.

Down the line, AI and ML will be able to predict future trends based on past data.

This kind of predictive analysis is a game-changer, offering insights and forecasting capabilities that could revolutionize tax planning and strategy.

Human and AI are the new tax superheros

Here's the good news.

You don't have to be an AI expert or ML specialist to put these technologies to work in your firm.

They’re increasingly being embedded into tax software, making these advanced capabilities readily accessible to you.

QuickBooks uses AI and ML to interpret anonymized information from millions of users. This helps businesses to manage revenue, handle tax payments, and other processes.

Xero also has features that use AI and ML. These carry out tasks like predicting contact and account codes for transactions. It ensures users don't have to manually enter new contacts or codes when reconciling transactions.

Data-driven advising can elevate your client game

Joshua Lance, Head of Accounting (AMER) at Ignition, also points out that, "AI can be super useful for tax accountants. It enables you to do tax research more effectively. AI being implemented into the tools we already use – including our tax software and research databases – allows accountants to have more time to advise clients instead of tracking information or doing data analysis.”

We can see this in action in Thomson Reuters’ tax research tools for example, which are also powered by AI and ML.

Forget the fear mongering about AI taking your job.

Joshua Lance flips the script. In his view, AI is a career enhancer. These smart technologies are your ticket to providing greater value to your clients. It’s your opportunity to evolve from a transactional service provider.

"If I'm a tax professional who's just worried about doing 1040s and compliance work, then AI may take me out of the game. But that shouldn't be my focus if I am truly developing an advisory relationship with my clients," he says.

"AI allows me to understand the context of my client so I can provide the best advice possible. And in many ways, that will make me a better advisor overall," says Joshua Lance

Your real-time tax strategy

The cloud is your command center. It’s transforming the tax landscape by giving you access to data and collaborative work environments.

Your new workspace is wherever you want it to be. With clients a click away, updates are as dynamic as your workflow.

Cloud technologies are also streamlining tax preparation. For one thing, they offer storage and retrieval of important documents.

Your critical documents now reside on secure, often geographically dispersed servers. Past tax returns, receipts, and key financial statements? They’re always at your fingertips.

When tax laws and regulations change, these next-gen tools also update, helping you stay compliant. So, when you’re preparing or reviewing taxes, you’re making informed decisions with the latest information.

Expect the tech wave to keep rising in the accounting world. According to Accounting Today, nearly two-thirds of accountants plan to implement cloud solutions by 2024.

This move to the cloud, says Joshua Lance, is vital for those who want to stay competitive – particularly with the rise of technologies such as AI.

"There are still a lot of accountants that haven't fully adopted a cloud-first strategy in their practices," he says. This is a problem because not migrating to the cloud curbs professionals' access to more advanced tools.

"It will be 10 times harder to leverage AI with legacy software. That's why I think having a good cloud strategy is important," says Joshua Lance

Failure to embrace cloud technology also limits your firm's appeal to potential buyers. Without this upgrade, you risk having to wind down your business rather than positioning it for a lucrative sale.

Turning data into dollars

Big data and predictive analytics aren’t just Silicon Valley buzzwords anymore. They can help you be a better accounting and tax professional – and advisor.

As more data-driven solutions enter the market – and these features are implemented into tax software – you'll be better equipped. You’ll be able to identify trends, make predictions, and provide strategic tax planning advice.

Imagine sifting through anonymized client data to spot trends. You’re advising clients with data-back confidence, transforming obscure numbers into actionable insights. That’s not just improving your business – it’s also revolutionizing the way you add value to your clients.

This becomes even more important as your firm grows, says Joshua Lance.

When an accounting practice gets bigger, it's all too easy for teams and data to get siloed. Having robust data and analytics solutions can help centralize information, empowering you to make better use of the data you already have.

Workflow processing is the engine behind a smoother tax season

In the rapidly evolving tax landscape, accounting firms face increasing demands for efficiency and value-added services. Workflow processing emerges as a game-changer. It allows firms to automate and standardize complex procedures.

Imagine it’s tax season. Your firm uses an integrated technology ecosystem to streamline the process from start to finish.

As soon as a client uploads their W-2 and 1099s through your secure portal, the system automatically categorizes this data into your tax preparation software.

Algorithms flag potential discrepancies and overlooked deductions. This frees up your accounting and tax professionals to focus more on value-added services like tax planning.

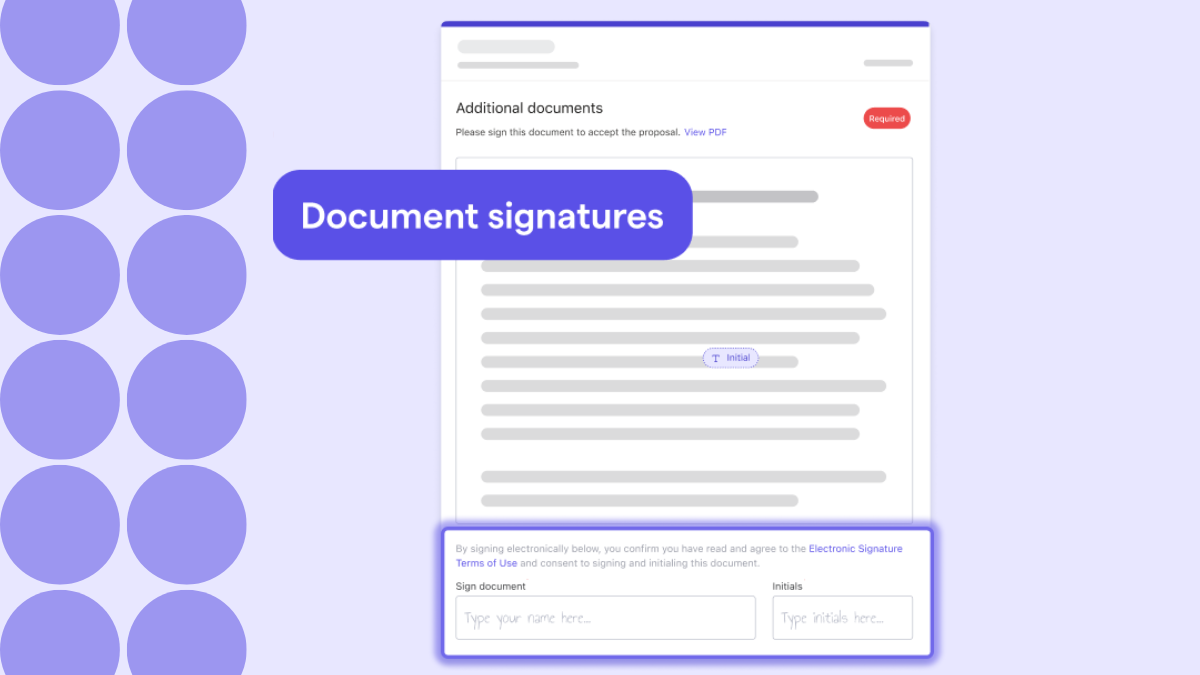

The system then facilitates internal review, client e-signatures, and the actual e-filing to the relevant tax agencies.

This entire automated process minimizes manual effort. It reduces errors. And it opens up opportunities for you to provide strategic tax advice. You can enhance your client relationships and your firm’s profitability.

Regulatory technology (RegTech) makes compliance a breeze

Let’s be real. The US tax system isn’t exactly known for its simplicity.

And while it might be a myth that the US tax code is a 70,000 page tome, the mind-bending complexity of the system isn’t.

Enter RegTech. It’s a valuable tool in managing the ever-evolving maze of tax regulations and compliance requirements. RegTech solutions can track and interpret regulatory changes, automate compliance reporting, and help firms stay ahead of the regulatory curve.

RegTech uses AI, ML, and data analytics to process large volumes of data and ensure adherence to tax laws and regulations.

As powerful as RegTech is, it's important to note that it's not a one-size-fits-all solution.

Tax laws vary significantly across jurisdictions and are subject to frequent changes. So, RegTech solutions must be flexible and adaptable, capable of keeping pace with changing regulations.

Opportunities for accounting and tax professionals

The ongoing wave of digital transformation in the tax landscape presents a wealth of opportunities for tax and accounting professionals. The innovations discussed here aren’t just changing how tax operations are conducted – they're enabling practitioners to provide more strategic value to their clients.

Whether you're adopting AI, ML and workflow processing – or exploring the implications of RegTech – these technologies offer new possibilities for your firm and your clients.

Real-time data access and collaborative work environments aren’t perks – they’re prerequisites for a profitable and sale-ready firm.

Enhancing client relationships in a digital world

All that being said, implementing these technologies shouldn't strip away the human element from your client relationships. Instead, you can use these tools to enhance your client experience.

As Joshua Lance puts it, "You should utilize technology to your advantage, but you also want to make sure that you're preserving that human connection with your clients and not letting technology get in the way of that."

Next on the dial

Join us for the Reconciling SaaS interview series, when Ignition’s self-styled “recovering accountant” and CEO, Guy Pearson sits down with progressive firm owners to discuss the evolving landscape of accounting.

Don’t miss out on this comprehensive look at the tech revolution. Get into the latest episode now.

Curious to learn how Ignition could revolutionize your business? Watch our on-the-spot demo. Discover how Ignition automates and optimizes proposals, client agreements, billing and payment collection.

With Ignition, you can put an end to delayed payments, unbilled services, and tedious admin tasks once and for all.