The digital lifeline that streamlines agency operations

In a hyper-competitive landscape, agencies like yours are always on the hustle. You're aiming to not just wow your clients, but to also turn those 'wows' into billable hours and a healthy cash flow.

Navigating the labyrinth of late payments and scope creep can feel like a full-time job, taking your focus off what really matters – growing your agency.

So how do you regain control and steer your agency toward a more profitable future? Good news: you're not alone in this struggle, and we've got some proven strategies to help you out.

Ignition recently held a webinar on how to increase agency revenue by 25%. On the panel of industry experts were Ari George, Founder and Managing Director of White Key Marketing; Cormac Gray, Founder and Director of DUNK Agency and Founder of The Agency Mentor; and Alastair Coleman, Head of Growth at Spicy Web.

The panel revealed their secret sauce for business growth, client satisfaction, and revenue generation.

Watch the on-demand webinar now: Increase your agency revenue by 25%

Fixing the problem of scope creep and over-servicing clients

Out-of-scope requests and over-servicing clients are common challenges for agencies. Ignition recently carried out a ‘pulse check’ survey of 21 agencies in Australia employing up to 25 people. Most responses were from agency owners and founders. Fifty seven percent said they experience clients asking them to do work that’s out of scope, with 38% saying this happens all the time.

Cormac Gray said DUNK Agency, which specialises in digital growth for eCommerce and purpose-led brands, said they overcame the problem by productizing its services.

“We put all of our service offerings and deliverables within each service into packages and didn’t offer it to anybody [who wasn’t] the ideal type of client that we wanted to work with,” he said.

Pricing your services to avoid scope creep

Alastair Coleman said Spicy Web found it challenging to tackle scope creep because the agency used to offer bespoke pricing. “We realised that it wasn't fair, it wasn't transparent,” he said.

“It was very hard to bring up scope, because the price that we determined was based on what we thought was the right amount of campaigns; the amount of hours dedicated, and the client's expectations,” he said.

So, the digital marketing agency, which specialises in brand-focused website design and development, Google Ads, SEO, and paid social ads, instead gave clients the ability to choose between proposals that offered services as tiered packages.

This helped to manage scope creep, gave the agency an opportunity to upsell services, and gave clients the power to “go higher” if they wanted.

Turning scope creep requests into a lead generation tactic

Out-of-scope requests can also be a great way to grow your business, if client expectations are managed.

“My biggest advice is, put it in writing,” said Alastair Coleman. “You might have a video meeting… and almost laugh about it. Like, ‘Cool, I'll do it [for] free this time, and next time we'll have a look at it’.”

“That sort of plants a seed. And then even if you do something really small that's totally out of scope… put in writing what you've done and come up with a crafty message to remind them it's done for free, especially if the decision-makers might be cc'd on that email. And if they're not, try and get the decision-makers on there and just remind them.”

Alastair Coleman said after a while the client will either stop making out-of-scope requests or they’ll ask, ‘what else can we get from you?’ Which is the ideal situation.

Moving clients from bespoke packages to retainers

When Spicy Web moved its clients from bespoke packages to retainers, it affected the agency’s ‘older clients’ rather than new ones who weren’t on these packages.

“We decided we have to be patient because we don’t want to lose clients,” said Alastair Coleman. “There were a couple that dropped off, we did the numbers game and we weren't upset by it,” he said.

“Let's say, 15% of our worst paying clients from the start were the ones that didn't want to stay on. But we helped them [by saying], ‘Hey, we'll do this for another six months if you want, or three months, whatever it may be. We'll refer you to somebody else’.”

The right platform sets the right expectations with clients

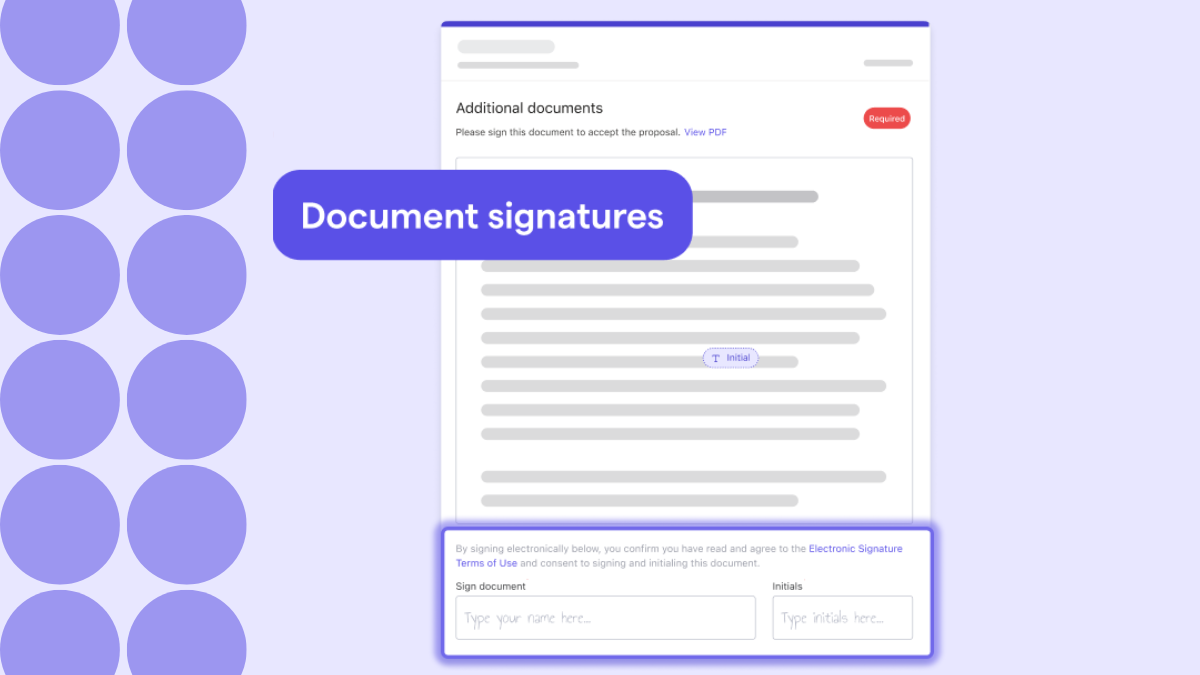

Ari George said if you use professional platforms and you’re “straight and down the line with all your deliverables, and you can hit everything with confidence, and you can show to your prospect client that you mean business”, clients are less likely to make out-of-scope requests.

His team at White Key Marketing creates unique campaigns with the specific goal of growing businesses through their digital platforms.

“My experience with Ignition is, when we have a professional platform [with a] process where everything is clear – you've got your deliverables; you've got your terms and conditions; you've got your signature at the end, and then you've got your ‘thank you for coming on board’ – people respect that, and they say, ‘okay, these guys mean business’.”

“You want to have things like Ignition in play so people don’t stuff you around,” said Ari George. “The ones that… still try to stretch you. I think it's best that you just let them go.”

Set your boundaries and stick to them

A lot of agency people let their boundaries slip and allow scope creep to come in because they want to really land a deal, said Cormac Gray, whose business The Agency Mentor, coaches agency owners to grow profitability.

Ari George agreed: “You might have a client that just doesn't end up paying you or that just tries to stretch you way too much, and you're thinking, ‘why are they doing this?’

“A large majority of the reason is you didn't teach them from the very start how to respect you,” he said.

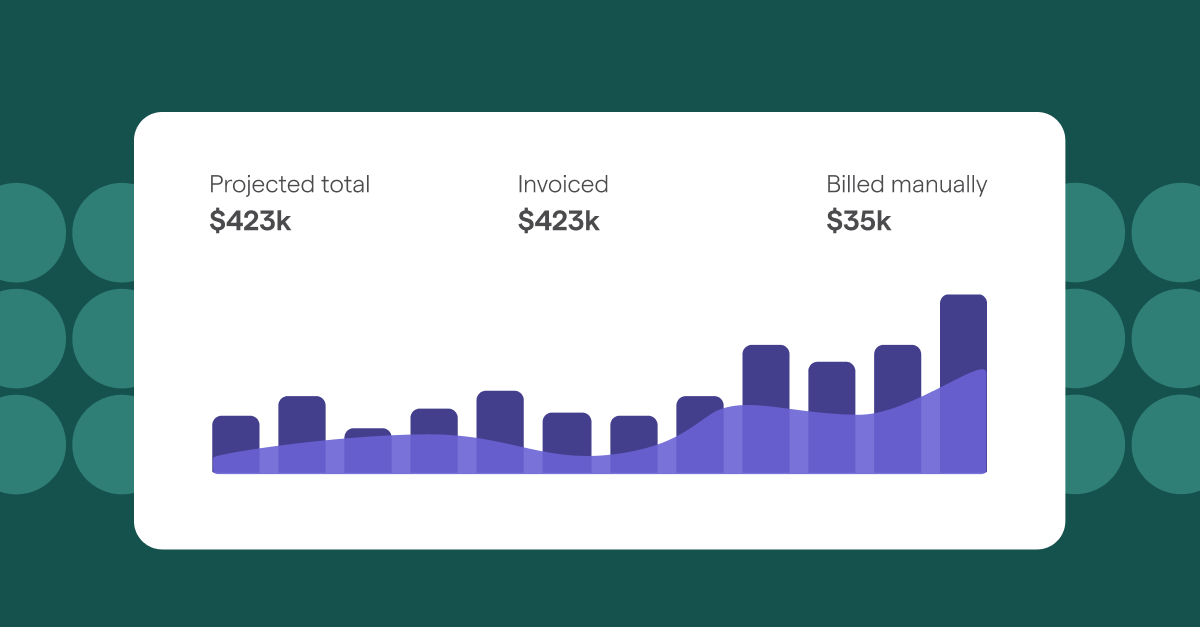

Automate your billing to avoid accounts receivable

Unbilled out-of-scope work is such a problem for the agencies surveyed by Ignition, in its industry pulse-check survey, that 57% of respondents estimated it costs them over $5,000 per month.

In response, Cormac Gray stressed the importance of cash flow. “When it comes to those months where margins are thin and money needs to come in the door and you could sometimes be staring down the barrel of payroll, that is quite daunting.”

He said to avoid late payments and out-of-scope work that you never bill the client for, the most important step agencies can take is to automate their billing process. This is essential if you have a high volume of clients.

“Every single one of our clients is on a direct debit system. We don’t send out manual invoices. If I was to sit here and send out manual invoices, I would have no time to really focus on the important things within my business, such as growing it, which is my number one role,” said Cormac Gray.

“All of our clients, we switched them into accepting proposals, putting their direct debit details in and getting billed on the nineteenth; the second; the eighth of every single month.

“Anybody that didn't get billed or missed a bill… we set up a simple process to follow those guys up and say, ‘Hey, you missed this bill payment’, he said. “So we don't have this issue of an accounts receivable buildup within our agency.”

Use upfront payments to get paid before you start work

Alastair Coleman said getting clients to pay upfront is key to managing cash flow.

“The biggest thing that we do [and], we've been very strict about it, is no matter what service it is, there's a prepayment in there… Larger organisations have a procurement date process like 30, 60 days. Because it's a high paying and credible client, we're willing to wait. But in general, everyone goes into Ignition, even deposits go in there, and we get money before we start.”

“Ignition's really good at reminding you that people haven't paid. That's the best part. You actually get an email saying this client has insufficient funds, whatever the reason is. That's really, really the best part of Ignition for me. It's really, really quick,” said Alastair Coleman.

“You can [also] generate an encrypted link that sends to the client, and they can update their payment method, add a new payment method, change it from credit card to bank, and vice versa,” he said.

Upfront payments help you manage cash flow and your own time

Ari George said when you’ve got cash flow problems, the knock-on effect is far reaching.

“If you don't have a system in place where you're getting the money coming… you'll find yourself so much on the phones, spending all that time calling people,” he said. “Time is the biggest commodity for all business owners.”

“The more we respect our time and focus on that business development, the more you can move forward, focus on your operations and your sales, and marketing. You need a system like Ignition to basically run itself from the back, where basically that money's just coming in,” said Ari George.

Have the conversation with clients about moving to direct debit

Alastair Coleman said large organisations may favour a procurement process over credit card payments. “The good thing is with Ignition, you can simply turn off recurring billing and you can just, say, send them an invoice,” he said.

Cormac Gray added: “We've got seven and eight figure brands that when we initially put forward to them a direct debit system, some of them were like, ‘I don't really feel comfortable doing that’. The way that we tackled it was we just had an open and honest conversation.

“You're only really going to get the biggest pushback when you start transitioning your older clients and trying to teach them the new trick of getting on to direct debit… and they're like, ‘I'm quite happy paying 20 days late, that's good for my cash flow’,” said Cormac Gray.

“We found that those guys were the problematic ones anyway, so they just left. But it's really just a conversation to have with them as it comes up.”

He said the issue doesn’t usually come up with new clients, “because the new clients come in not knowing anything else,” he said.

Want to attract more clients and top talent? Get your branding right

Ignition’s industry ‘pulse-check’ survey found that 57% of respondents reported they are operating on a leaner budget. Forty seven percent said they are struggling to find and retain top talent.

So, how had the panel tackled this issue of finding, retaining talent and operating under the constraints of business in 2023?

“A lot of agency owners neglect their own branding, and it's honestly branding that is the number one tool that's landed us more work than a paid ads funnel has done,” said Cormac Gray. “Branding is great for getting clients, but branding is really great for landing team members as well,” he said.

He also emphasised the need to create services that drive value for clients.

“We get so caught up in trying to develop the best services with the right deliverables at the right price that works for us. And so often we just forget about the client and the outcome, and the result that they're after.”

“What I would recommend is trying to create something that is a no-brainer offer that drives a ton of value for a client on a recurring basis that they would be stupid to say no to,” said Cormac Gray.

Where to go from here

When you're focusing on scaling your agency, it can be hard to keep the personal touch. But all-in-one platforms like Ignition – specifically designed for professional services – help you to manage proposals, agreements, billing and payments, all in one place while keeping the experience personalised for your clients. Want to find out more about Ignition? Watch an instant demo.