Inside the 6-hour workday: Video highlights from Dawn Brolin and Marcus Dillon

For many accountants, bookkeepers, and other tax professionals, tax season equates to ‘no-life’ season – an all-consuming period that occurs year after year. But finding that sweet spot between work and life? It really is possible.

In our recent webinar, “The 6-hour workday is possible: Strategies to get your firm's time back and avoid burnout this tax season,” I moderated a panel discussion with Dawn Brolin, CPA, CFE, and the powerhouse CEO behind The Designated Motivator and Powerful Accounting, and Marcus Dillon, CPA and Owner of Dillon Business Advisors (DBA).

These pros revealed how they cracked the code to a six-hour workday, without losing their sanity.

Read on for insights into how to turn over a new leaf this tax season and reclaim your life. It's time to level up your game (which, in Dawn Brolin’s case, is a combination of softball and accounting).

Taking control of tax season

Marcus Dillon knows the tax season struggle firsthand. Not that long ago, his work-life balance was virtually nonexistent, and he neared his breaking point before making some pivotal changes.

This led to a fundamental change in his firm and the types of clients they served. Now, he’s living proof that a ‘6-hour workday’ is within reach.

Likewise, Dawn Brolin, a passionate softball coach, sought her own balance by reshaping her business model to prioritize her love for the game – and generally her time outside the office. Her journey from the demands of tax season to “softball season in which we do taxes” will inspire those looking to make room for what matters most without sacrificing your career or business.

Tips and tricks for achieving a 6-hour workday

Marcus and Dawn's success stories shed light on a number of key strategies that accountants and tax professionals can apply to their own firms:

1. Prioritize your business needs first – it’s time to “draw the line” when client processes impact your firm, explains Marcus Dillon.

2. Have the confidence to ask clients to pay upfront, says Dawn Brolin. Avoid cash flow headaches and having to chase clients for late payments.

3. Keep a close eye on staff capacity to prevent burnout and consider ways to help your team recharge, says Marcus Dillon.

Another successful strategy Marcus implemented to avoid staff burnout was offering his team ‘half-day Fridays’ outside tax season to give them back some of the extra hours they’d worked. Eventually, the firm worked up to ‘half-day Fridays’ every week.

How revenue-generation technology can play a role

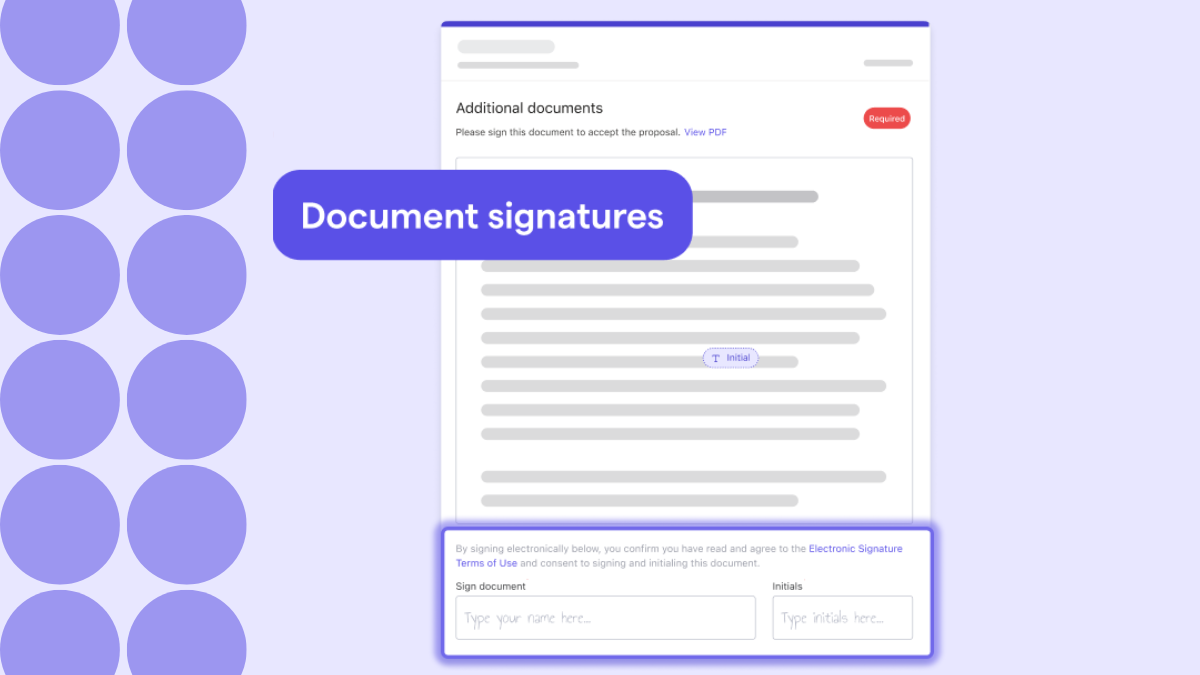

As well as taking the mental leap and making business model changes, technology platforms can help you tackle – and tame – tax season, too. Ignition, for example, is the leading revenue generation platform for accounting and professional services. The platform makes it easy to engage clients, bill and get paid for all of your firm’s work, to maximize revenue, cash flow and efficiency.

By automating tasks such as generating client engagement letters and proposals, client billing, and collecting payments, Ignition streamlines your workflows.

With Ignition’s upfront payments feature, you can eliminate late payments and cash flow worries, and get more time back in your day. In fact, Ignition customers save on average over 18 hours per week engaging clients, managing scope changes, and billing, collecting and reconciling payments. This allows you to focus on what truly matters: serving your clients, growing your business, and having more time for what’s important to you.

Initially, cash flow was a significant issue for Dawn. So, she turned to Ignition’s automation for help.

The benefits didn’t end there. Ignition has helped streamline Dawn’s business in other valuable ways, such as being able to quickly and easily convey her pricing – and price increases – to clients.

Moving from tax returns to tax advisory services

For both Marcus Dillon and Dawn Brolin, taking control of tax season has meant actually shifting their mindset from seasonal to annual. Transitioning from the once-a-year tax return grind to year-round tax advisory services has changed the game for them – and their firms.

Marcus Dillon's firm has introduced an innovative Team of 3 approach, assigning each client a client controller, client service manager (CSM), and client CFO. This tailored support ensures that DBA fully meets every client's needs throughout the year and the heavy workload doesn’t fall to one staff member.

For Dawn Brolin's firm, the shift has been about moving away from the intense, deadline-driven culture of tax season and embracing a more strategic, proactive approach to advising clients year-round.

By focusing on planning and guidance beyond tax deadlines, Dawn's team has empowered clients to make smarter financial decisions and navigate complexities with confidence. Plus, she’s reimagined tax season for her own team.

Explore more

Finding and educating your ideal clients for tax advisory

Transitioning clients from one-off tax returns to a year-round advisory relationship requires you to be proactive, and there’s an education piece, too – you have to let your clients in on your plans so they come on the journey with you. Plus, your clients also have obligations and responsibilities as individuals and business owners to provide the information accounting and tax professionals need.

Educating clients starts with transparency and communication. Be upfront about the shift in focus and the benefits of a year-round advisory approach. Show them the value of proactive planning and strategic guidance in achieving their financial goals. It's about building trust and demonstrating your commitment to their success beyond tax season.

As a firm owner, this also means mapping out what you want your life to look like – for Dawn Brolin, for example, this means more time in the softball dugout – and identifying which clients align with your vision.

This also involves learning to say 'no' sometimes. Not every client or situation will align with your new direction, and that's okay. If they’re not your ideal client, recognize when it's time to refer them to other firms better suited to meet their needs. Marcus Dillon explains below.

By focusing on your ideal client and guiding them with tax advisory services, you can create a more fulfilling and sustainable practice for yourself and your clients.

Absolute apps for accountants, bookkeepers, and other tax professionals

Putting them on the spot, I asked both Dawn and Marcus to name their must-have apps for efficiently running their firms.

Their tools cover their bases – another softball reference for Dawn – from top-notch accounting software such as QuickBooks Online to their all-important practice-management tools. Then there are the automation platforms, such as Ignition. With features that automate repetitive tasks, provide templates for engagement letters and proposals, and eliminate cash flow worries by making sure you get paid, Ignition streamlines your operations and boosts your productivity.

Final advice for accounting firms this busy season from the tax experts

With tax season upon us, Dawn and Marcus had some final parting words of advice for accounting firms looking to transition to tax advisory services and regain some work-life balance.

Marcus emphasized not feeling bad about taking care of yourself and your business first – without guilt.

Dawn echoed this sentiment, urging firm owners to embrace change and take action when things aren't working. Don't be afraid to pivot and try new approaches that prioritize your wellbeing and fulfillment.

Discover how Ignition can transform your busy season

Ready to learn more about how Ignition can help you have a productive busy season – and still let you have the work-life balance you want? Watch an instant demo and see how the leading revenue generation platform for accounting and professional services can help you save time, price your services, collect payments upfront, and so much more this busy season.