“GaryVee” webinar: You better wake up if you're not using technology

Listen up accounting and tax professionals – it’s high time we started moving with the times and stop leaving dollars on the table.

Ignition recently teamed up for a webinar with the legendary Gary Vaynerchuk (better known as “GaryVee”), who is cited as “one of the most forward thinkers in business – a prolific angel investor in companies such as Facebook, Uber, Twitter, Tumblr, Venmo, Snapchat and Coinbase”.

Together with a panel of seasoned accounting and tax professionals, they tackled some of the biggest challenges facing our profession today during Ignition’s webinar: Stop underselling: Learn from "GaryVee" and Experts on How to Grow Your Firm With Technology.

8 Top takeaways from the discussion

- Stop underselling: Accounting and tax firms are leaving an average of $76,000 on the table each year due to out-of-scope work. It's time to earn more, and not give away services for free.

- Tech is non-negotiable: Adopting technology is not just a recommendation; it's a necessity for survival in today's digital age. Everyone should be using AI every day.

- People skills matter: Despite the tech, human interaction is still a huge part of the game.

- Make bold moves: Learn the art of valuing your services and ask your clients for what you're really worth.

- Content is king: Boost your online presence through frequent and meaningful content, especially on platforms like LinkedIn.

- Future-proof your business: Big tech companies are eyeing your market; adapting now can make all the difference.

- Learn from the pros: Tune in to our four-part webinar series where seasoned experts share their secrets to a more profitable firm.

- Ignition is your ally: Streamline your client engagements, billing, payment collection, and much more. Say goodbye to late payments and tedious admin tasks.

What happened: An hour of insights, revelations, and strategies

Matt Kanas, Ignition’s Managing Director for AMER, moderated this exciting and profitable conversation with Dawn Brolin of The Designated Motivator and Powerful Accounting; Tiffany Davis, CEO and Founder of Washington Accounting Services, and Logan Graf, Chief Tax Officer and Founder of The Graf Tax Co.

Why should you care? Because firms like yours are leaving on average, $76k on the table – each year – due to out-of-scope work. Read on to find out what happened in this hour of jaw-dropping insights and no-BS revelations.

In this action-packed hour, our fast-talkin’ panel tackled a lot! Here’s a sneak-peek review:

Hard truth about underselling your services

The elephant in the room that got this whole webinar underway was that clients are getting more than they're paying for from accounting and tax professionals.

Our panel didn’t shy away from saying that many firms are drastically underselling themselves – even giving away their services for free!

A hint at the antidote?

Learning the art of valuing your services. Start ditching the fear, and embracing the bold move of asking clients for what you're worth.

A no-holds-barred conversation

“GaryVee” is a passionate storyteller and he was vocal on a number of topics. He evangelized and made recommendations about artificial intelligence (AI), YouTube Shorts, TikTok, LinkedIn, and more.

With AI, for example, he says: “Everybody here should be using AI every day. And nobody is. I know that to be true. It's that early; I get it. By the way, me included. I’m giving my advice to myself. I really need people to wrap their heads around not understanding how to use better tools.

“Like, you can get a screw into a wall by using a rock, but we invented the screwdriver – use it! Or you can eat with your hands – I, by the way, do that often – but the fork exists! The concept of not using software to make more money and have more time for your family – bananas to me,” says “GaryVee”.

When Matt Kanas followed up by asking “GaryVee” what he thinks is the barrier or friction point to adopting software, he had a hard-hitting response: “Bullshit, ideology, complacency, and laziness! They’d rather not put in the work … It's an ideology and a demonization and an insecurity that they can't learn it without realizing they're way more capable than they think.”

Similar to not leveraging AI, accountants and tax professionals should be better with their online presence, says “GaryVee”, voicing concerns: “Everybody here should be making two to three posts on LinkedIn a day to get customers … I'm worried about everyone here not producing content on social media. I'm worried about everybody here not having their website [functioning] properly.”

The upshot is… you’re not doing enough!

Adopting tech is more than a choice – it’s necessary for survival

He also shared real-life examples of why you need tech, as well as some great personal anecdotes and analogies. There was one we all can relate to, in which “GaryVee” likened making the mental jump to technology adoption to going to the gym. The key is forming a positive habit:

“You will make more money, and you will have more time, and you will be happier if you make the commitment [to technology] – it’s no different than eating better and going to the gym will be better for your health. News alert. It's better,” says “GaryVee.”

What’s more, he shared his genuine worries for the accounting and tax profession. Especially if you don’t keep up with the times.

“Let there be no confusion,” warns “GaryVee”. “The Googles and the Apples and the Amazons? They’re coming for your business, everyone. You better wake up.”

Pivotal shift when cash flow crises meet tech epiphanies

Turning to our panelists, they touched on what the catalysts were for them to make the all-important change and leverage technology to scale and grow their companies.

For Dawn Brolin, improving her cash flow was paramount. “Cash is king; if you don't have money, you’re not in business,” she says. “That's just a rule I was taught years ago … and I worried every Monday for 23 years – 52 weeks a year – do I have enough payroll for Friday?”

Then, about a year ago, she said: “I’m done with this. I'm gonna change what I do, because 94% of accountants say they have to chase clients for late payments, and I was that person! I was the chaser, because I felt bad,” she says.

Conversely, Tiffany Davis already had the get-the-money-first and the technology mindset. “My issue was, now I’m growing, so how do I scale this?” The revelation she came to? Offering her services as tiered packages.

Logan Graf’s motivation was clear-cut: earn more, give away fewer of his services for free through out-of-scope work. For him, the answers were investing in technology and automation. As an accountant, he recognizes the drive to save money – that’s what accountants do! “But sometimes you have to bite the bullet and invest,” he says. The payoff, he says, is worth every dime.

“GaryVee” in the hot seat: Hard-hitting Q&A and unmissable insights

Peppered throughout the webinar were questions for our guest, “GaryVee”. Our panel grilled him on everything:

- From how he zeroes in on industries ripe for digital disruption with his knack for understanding tech's transformative power.

- To why he’s such a fervent advocate for tech adoption.

- To what are the barriers of tech adoption.

- To what accounting professionals need to shift to attract and cater to Gen Z, a tech-savvy, fast-paced generation, as they come into the financial landscape.

And more!

Ultimately, people skills are still paramount. “It's a human game. “But scaling the humanity is what I'm trying to get everybody to do," “GaryVee” says. "I want you to use technology to scale your humanity. I want you to use technology as a gateway drug to your human skills."

And just when you think he’s covered it all, he drops one last piece of advice for accounting and tax professions, based on the discussion and comments throughout the webinar.

"This is an insular game… you take your two index fingers and you put them in your ears and you worry about nothing besides you, and what you can do about what you need to do. If you do not want to use technology after the motivation that we've done here for an hour, mazel tov for you. But if you get your ass kicked [in] the next two or three years, you better own it," says “GaryVee”.

Where to from here?

It’s time for you to stop underselling and start running a more profitable firm. Join us for our four-part webinar series where seasoned accounting and tax professionals will debate and share their lessons and viewpoints – from rethinking tax season and pricing, to exploring sales techniques and effective client engagement strategies.

We promise – this isn't just your run-of-the-mill webinar series. It’s a call for professionals like you to step up and capitalize on the power of tech.

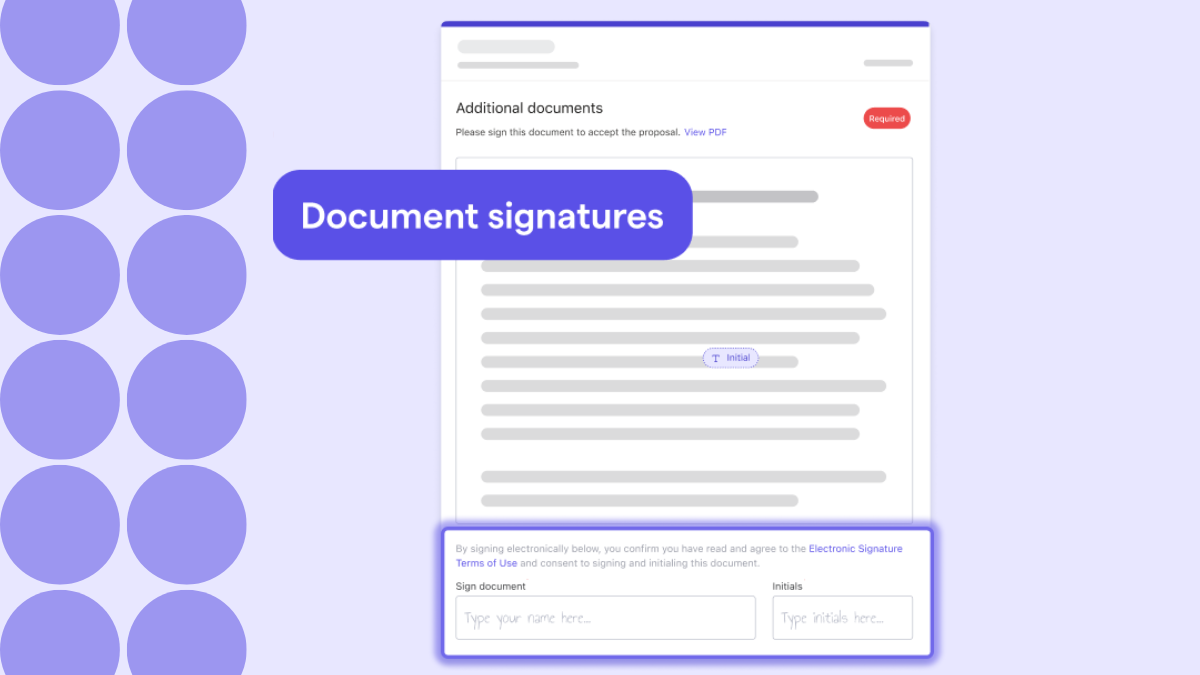

Want to learn more about how Ignition can revolutionize your business? Watch our on-the-spot demo. With Ignition, you can put an end to delayed payments, unbilled services, and tedious admin tasks once and for all.