Effective cash flow strategies for accountants and bookkeepers

With leading Australian economists forecasting the chance of a recession in 2023-24, the role that accountants and bookkeepers play as trusted advisors is likely to be more crucial than ever this financial year.

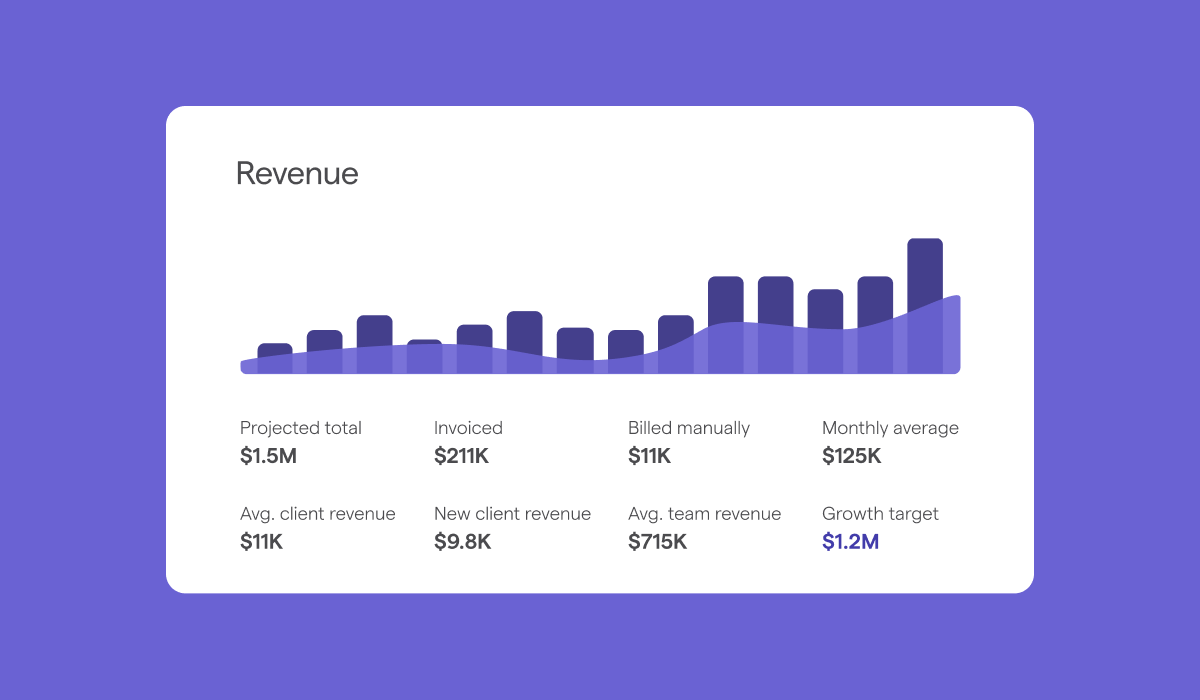

Beyond reducing tax burdens, accounting and bookkeeping professionals are the guardians of financial stability for individuals and businesses alike. Amid these economic pressures, it's paramount for practices to have a healthy cash flow. Just as your clients are grappling with economic uncertainties, your firm is not immune. A robust cash flow ensures your capacity to weather economic fluctuations, continue providing valuable services, and secure the financial stability of both your firm and your clients.

Read on for eight actionable strategies to enhance cash flow, empowering your firm to deliver exceptional value to your clients and achieve a zero debtors practice, regardless of the economic times.1. Streamline your billing process

Maintaining a steady cash flow requires both timeliness and accuracy in your billing process. Even in the best of times, late payments and out-of-scope work (also known as ‘scope creep’) can cause cash flow issues. In fact, according to Ignition’s State of Client Engagement in Australia report, 95% of accountants and bookkeepers said they experience the awkward situation of chasing clients for late payments and clients not being billed for out-of-scope work. And 35% of accountants and bookkeepers manage increases in scope by just absorbing the increased time and cost themselves.

But in times of economic volatility, the significance of automated and efficient invoicing is more apparent than ever. A streamlined billing system is an essential tool in your survival kit.

Software like Ignition brings together client billing, payments, proposals, client agreements, and workflow automation – all in one platform. Having everything in one place ensures that you can promptly access the data you need, facilitating quicker, more efficient invoicing. The platform's intuitive design allows for effortless control of upcoming client invoices and client payments.

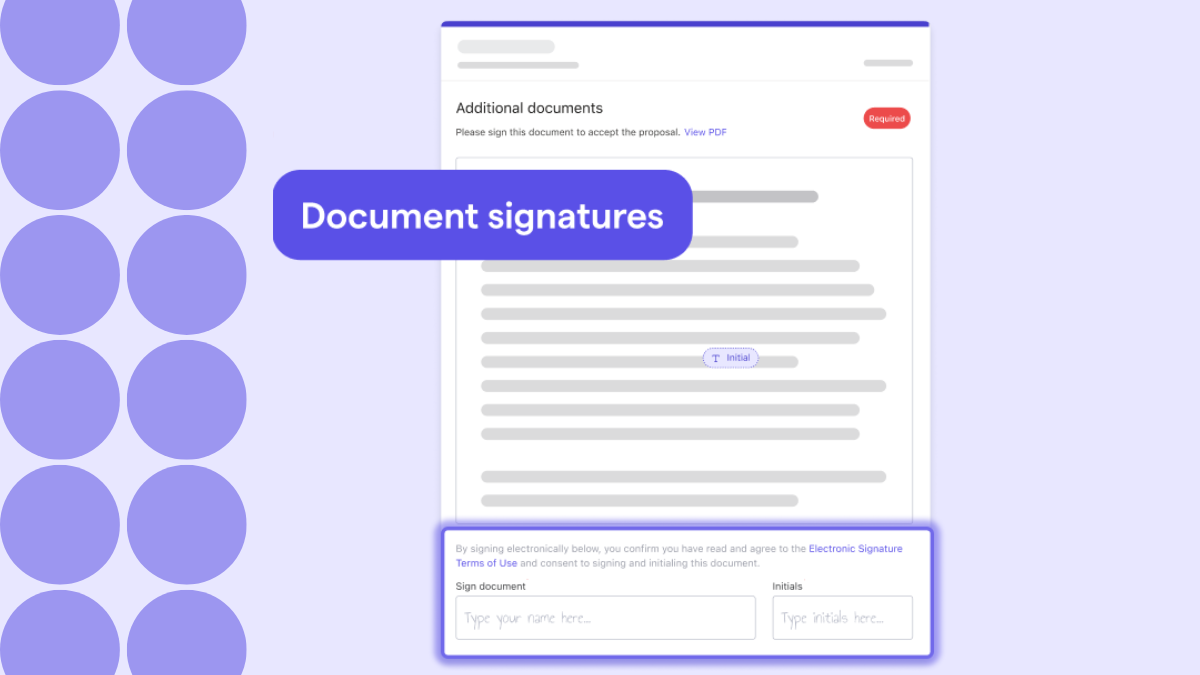

What’s more, with Ignition you can take upfront payments. This can eliminate your exposure to the risk of non-payment. This approach provides an assurance of payment, anchoring your cash flow even in uncertain economic conditions. You can collect payment details upfront and automate payment collection from the moment a client signs your proposal.

By securing credit, debit card and direct debit details upfront, you have the flexibility to invoice and collect payment automatically, rather than crossing your fingers and hoping you’ll get paid when you invoice on completion.

Strategies like this can not only enhance your cash flow, but also frees up your valuable time. You can automate billing and payment collection based on your billing and fee schedule, and ‘set and forget’ once a client signs your proposal.

Using streamlined billing processes like these, can help you navigate the challenging economic times and safeguard your financial stability.

2. Offering cash flow consultancy

As an accountant or bookkeeper, you have a unique vantage point that puts you in the perfect position to consider offering cash flow management advice. In turbulent economic times, your expertise is invaluable to clients who are navigating uncertain financial waters. By offering cash flow consultancy services, you could guide your clients through the more intricate aspects of financial management, such as cash flow forecasting, expense tracking, and cash reserve strategies.

Plus, the benefits of providing cash flow consultancy extend beyond your clients. By supporting clients in achieving healthy cash flow, you're also contributing to your own firm's financial wellness. As clients become more financially stable, they are more likely to pay their invoices promptly, helping you achieve a zero debtors practice.

Another plus? Cash flow consultancy can evolve into an additional revenue stream for your firm. As you help clients solidify their financial footing, you create a cyclical process of financial health – the better your clients do, the better you do. In this way, offering cash flow consultancy is not only a service but also a strategic move towards financial stability and growth for your own firm in challenging times.

Expanding your range of service offerings can open the door to a broader spectrum of clients, catering to varying needs and fostering a more robust, resilient client base. An essential aspect to consider is the requisite skillset. While your firm possesses extensive accounting and bookkeeping expertise, this new endeavor might mean you need to upskill or retrain your team. Launching new services during an economic slowdown and with rising interest rates can also be risky. But with the right strategies and processes in place, it is possible for your firm to overcome these challenges.

Read the Step-by-step guide: How to offer new services to increase your firm’s revenue to find effective strategies for selecting, pricing, and marketing services – and how you can streamline your entire client engagement process.3. Diversify your services

A diversified service offering can not only enhance your firm's appeal to a wider range of clients but also help your existing ones, who may be in need of these services. With the right strategies and planning in place you could delve into such areas as:

Business strategy consulting: A keenly sought-after service in an era where strategic agility is key to survival.

Risk management: Another domain where your financial acumen can be invaluable, as it enables clients to safeguard their operations amid volatile market conditions.

Debt restructuring advice: This can be a lifeline for clients wrestling with financial distress.

4. Adapt your pricing

Selecting the right pricing strategy for your practice is crucial, particularly in times of high inflation, where costs can surge unexpectedly. Making sure your prices cover your costs and highlight the value you provide is key. But how can you confidently adapt your pricing without undercutting your value, and risk losing your clients?

Ignition offers a practical guide to assessing your fees and managing unbilled work. This comprehensive guide can support you in accurately pricing your accounting or bookkeeping services, reflecting the true value you bring to your clients.

Adjusting your pricing also necessitates transparency. Informing clients about changes in fees maintains trust and promotes strong client relationships. With clear pricing, your clients can better understand the services and value they receive, making them more likely to pay invoices promptly.5. Leverage technology and automation

Harnessing the power of technology and automation is a game-changer in the world of accounting and bookkeeping. The right tools can significantly increase efficiency, increase revenue, and empower you to get paid faster.

Ignition, for example, is an all-in-one proposal, client agreement, billing payment and workflow automation platform. It’s designed especially for professional services providers, including accountants and bookkeepers.

With Ignition, you can automate a host of administrative functions that typically take up a substantial amount of your time and resources. From project management and client communications to real-time financial analysis, Ignition provides an integrated solution, optimizing your workflow and enhancing your productivity.

By liberating you from repetitive, mundane tasks, Ignition allows you to concentrate on the core elements of your practice. This increased focus contributes to a more efficient firm and is another step towards a zero debtors practice. After all, a more efficient practice is a more responsive one – better equipped to manage cash flow and serve clients effectively.

6. Cut non-essential costs

In times of economic uncertainty, a thorough review of your expenses can help identify areas where you could potentially cut back on or eliminate non-essential costs. This may involve renegotiating contracts with suppliers or reducing discretionary spending.

However, it's crucial to recognise that not all costs are created equal. Some expenditures are vital because they drive efficiency, deliver value, and support your firm's strategic goals. Be careful to avoid cuts that could impact the quality of your service or client satisfaction.

Also, be on the lookout for special offers, such as free trials, discounted subscriptions, volume discounts, referral programs, bundle offers, and educational resources, from essential service providers. These can help manage expenses without compromising the tools and services crucial for your firm's efficiency and growth.

7. Encourage referrals

No doubt, you already know that client referrals are one of the most effective methods for growing your client base. They harness the power of word-of-mouth, using existing relationships to establish trust and create new opportunities. By driving your client growth, referrals directly impact your cash flow and contribute to your firm's financial stability.

To encourage referrals, consider offering your clients a meaningful referral incentive (as mentioned above). This could be a complimentary consultation or a dedicated session on a financial topic of their choice. Incentives like these genuinely demonstrate your appreciation for your clients and foster an even stronger professional relationship.

Also, make it easy for your clients to refer you. This might involve creating a simple referral process or providing them with materials about your services that they can readily share with their network.

Every client who champions your services extends your reach, building your reputation and growing your practice. By cultivating a culture of referrals, you strengthen your cash flow and lay a robust foundation for a thriving, resilient business.

8. Effectively use client engagement letters

Your client engagement letter serves as a vital cornerstone in your relationship with your clients. It provides a clear framework, outlining the scope of work, payment terms, and the responsibilities of both parties. By setting clear expectations and ensuring mutual understanding from the get-go, these documents are instrumental in reducing potential disputes, ensuring prompt payments, and moving you towards a zero debtors practice.

With Ignition, your engagement letter forms part of your proposal to save you time. When a client signs and accepts your proposal, the software automatically converts it to an engagement letter, so you’re always covered.

Ignition also offers professionally designed engagement letter templates from selected accounting industry bodies. Less errors, less admin, while keeping you compliant.End late payments forever

Steering your accounting or bookkeeping firm through economic challenges requires being proactive in your cash flow management, diversifying your services, leveraging tech and automation, and generally building resilience. It also means addressing late payments, a common but surmountable hurdle. With Ignition, you can put an end to late payments forever, turning your cash flow worries into a thing of the past.

So your journey to a zero debtors practice is achievable. See how Ignition works now to learn more about how our platform can empower your firm to eliminate late payments and thrive, even during an economic downturn. With Ignition, you're not just weathering the storm but charting a course towards a more stable and profitable future.