Unlocking successful advisory services with personalized engagement letters

As accounting and tax professionals, we appreciate the pivotal role an engagement letter plays. This legal agreement outlines the scope of work, costs, and other crucial details, serving as a blueprint for the services you will deliver to your clients. It provides clear expectations, helps manage risk, and paves the way for harmonious client relationships. But what happens when you expand your offerings into the realm of advisory services? Do you need to change your approach to engagement letters?

The answer is a resounding yes.

Advisory services are often the most important issues that clients encounter in their businesses. Here are some examples of advisory services that you may offer:

- Tax strategy advisory to help clients develop and implement strategies to minimize their tax liability within the boundaries of the law. This can include advising on tax-efficient structures for businesses, planning for capital gains or inheritance taxes, exploring applicable tax credits and deductions, and ensuring compliance with all relevant tax laws.

- Cash flow advisory to help businesses manage their cash flow effectively to ensure they can meet their financial obligations and invest in growth opportunities. Cash flow advisors might analyze a company's inflows and outflows, identify patterns, forecast future cash flows, and develop strategies for improving cash flow management. This could include advising on credit management, inventory management, payment terms, investment strategies, or cost control. Proper cash flow management can help a business improve its liquidity, reduce risk, and enhance financial stability.

- Business consulting to help improve business performance and efficiency. This could include advising on organizational restructuring, business strategy development, operational improvements, and change management. Business consultants often use their expertise to provide an objective perspective, identify problems, and create solutions to help businesses meet their goals.

- Decision-making support to help clients make informed decisions by providing data-driven insights and analysis. This could include conducting market research, performing financial analysis, advising on risk management, or modeling different business scenarios. Decision-making support advisors provide crucial information and recommendations to support strategic decision-making processes.

These services involve a different scope of work compared with general tasks, such as, say, traditional accounting or tax tasks. For this reason, it’s crucial to adapt your engagement letter to match these unique services. Here are seven key ways you can do that.

Related article: Guide to increasing revenue with advisory services

1. Tailoring your scope of work

As you read above, advisory services can be broad, varied, and, in many cases, more complex than conventional compliance-related tasks. It’s vital to define precisely what services you will provide, because this helps to manage client expectations and reduce the risk of misunderstandings or disputes.

Given the diverse nature of advisory services, a one-size-fits-all engagement letter simply doesn't cut it. You should tailor the scope of services to the specific advisory services you're offering, making sure everyone involved is on the same page.

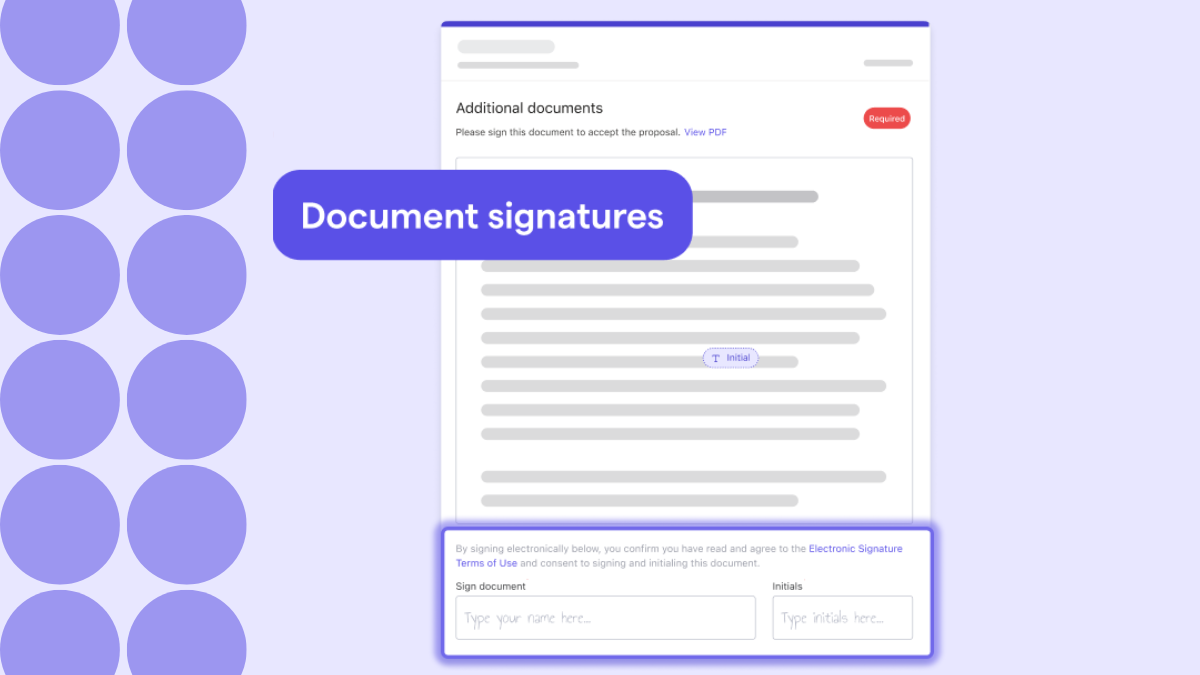

If this sounds time-consuming, it doesn’t need to be. You can create and send proposals and engagement letters in minutes using a platform such as Ignition, which also allows you to create your own custom templates. Using these, you can adapt your scope of work for different clients or projects, saving you time.

2. Clearly define your fee structure

Your fee structure for advisory services may also differ from that of your other services. You might be using value-based pricing for advisory, for example, and your engagement letter should clearly outline this fee structure to avoid any confusion or disputes about payment. Transparency about costs upfront can also contribute to stronger, trust-based client relationships.

3. Dealing with out-of-scope requests

In the complex realm of advisory services, clients may often have requests that exceed the agreed-upon scope outlined in the engagement letter. In these cases, engagement letters serve as a pivotal tool in managing client relationships and controlling the scope of your work. The document acts as your source of truth, grounding discussions and reminding clients of the original agreement – keeping everyone on the same page.

Crucially, when out-of-scope requests arise, the engagement letter also allows an opportunity for negotiation. Rather than accepting out-of-scope work without additional compensation, you can leverage the engagement letter to discuss amendments and additional fees for the extra work. In this way, you make sure that you are properly rewarded for all your efforts and maintain a transparent relationship with your clients. Think of your engagement letter not as a static document, but a dynamic tool that you can revise as the demands of your advisory services change.

For example, Ignition provides a service edits feature that makes it easier than ever to update a client engagement. With service edits, you can easily adjust the pricing and description of services to which your clients have agreed. It’s another way accounting and tax professionals can make sure you get paid for all the work you do.4. Establishing liability boundaries

Unique advisory services likewise carry unique risks. For instance, strategic business advice carries the potential for disputes if the client doesn’t see the expected results. So, your engagement letter needs to clearly articulate the limitations of your liability. This risk management strategy can help protect your firm and make sure that your client is aware of the inherent uncertainties in business advisory services.

5. Addressing confidentiality and data protection

When you’re taking a deep dive into your client's business, it can involve accessing sensitive data. Because of this, your engagement letter should address any confidentiality and data protection issues unique to the services you provide. For example, you might need to include additional clauses or reassurances about how you will protect your client's data, reinforcing their trust in your services.

6. Handling any potential conflicts of interest

Advisory services can also carry a different risk profile when it comes to conflicts of interest. For example, if you're advising two companies in the same industry, potential conflicts could arise. Your engagement letter should therefore clearly state how you will handle these conflicts. Being upfront about these issues can help maintain your professional integrity and client trust.

7. Setting the terms for termination

Finally, the conditions under which the engagement can be terminated might be different for your advisory services, especially if you provide these services on a project basis. In your engagement letter, it’s a good idea to detail the process for termination, including any notice periods, fees, or obligations. This clarifies expectations, should either party need to end the engagement.

Over to you

Building advisory services into your accounting and tax firm can be a rewarding venture, expanding your client base and offering new challenges. But it's essential not to overlook the legalities and formalities of these new services. Tailoring your engagement letter to suit advisory isn’t just a best practice; it's a necessity.

By paying attention to the scope of work, fee structure, risk management, confidentiality, potential conflicts of interest, and termination conditions, you can craft an engagement letter that serves both you and your client well.

This attention to detail can lead to clear communication, robust client relationships, and a successful advisory practice. It ensures all parties understand their roles, responsibilities, and the unique aspects of the advisory services you provide.

So, as you venture into the advisory world, take the time to revisit and revise your engagement letters. It's a small step, but one that could make a significant difference in the effectiveness and success of your services. It's not just about ticking a box for best practice; it's about building solid foundations for your advisory services and, ultimately, your firm's future growth. See how Ignition can help you create personalized engagement letters. Watch the online demo.